Life Insurance in and around Emporia

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It can be a big deal to take care of those closest to you, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or maintain a current standard of living as they grieve your loss.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Why Emporia Chooses State Farm

And State Farm Agent Peggy Malone is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Peggy Malone, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Peggy at (434) 634-3413 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

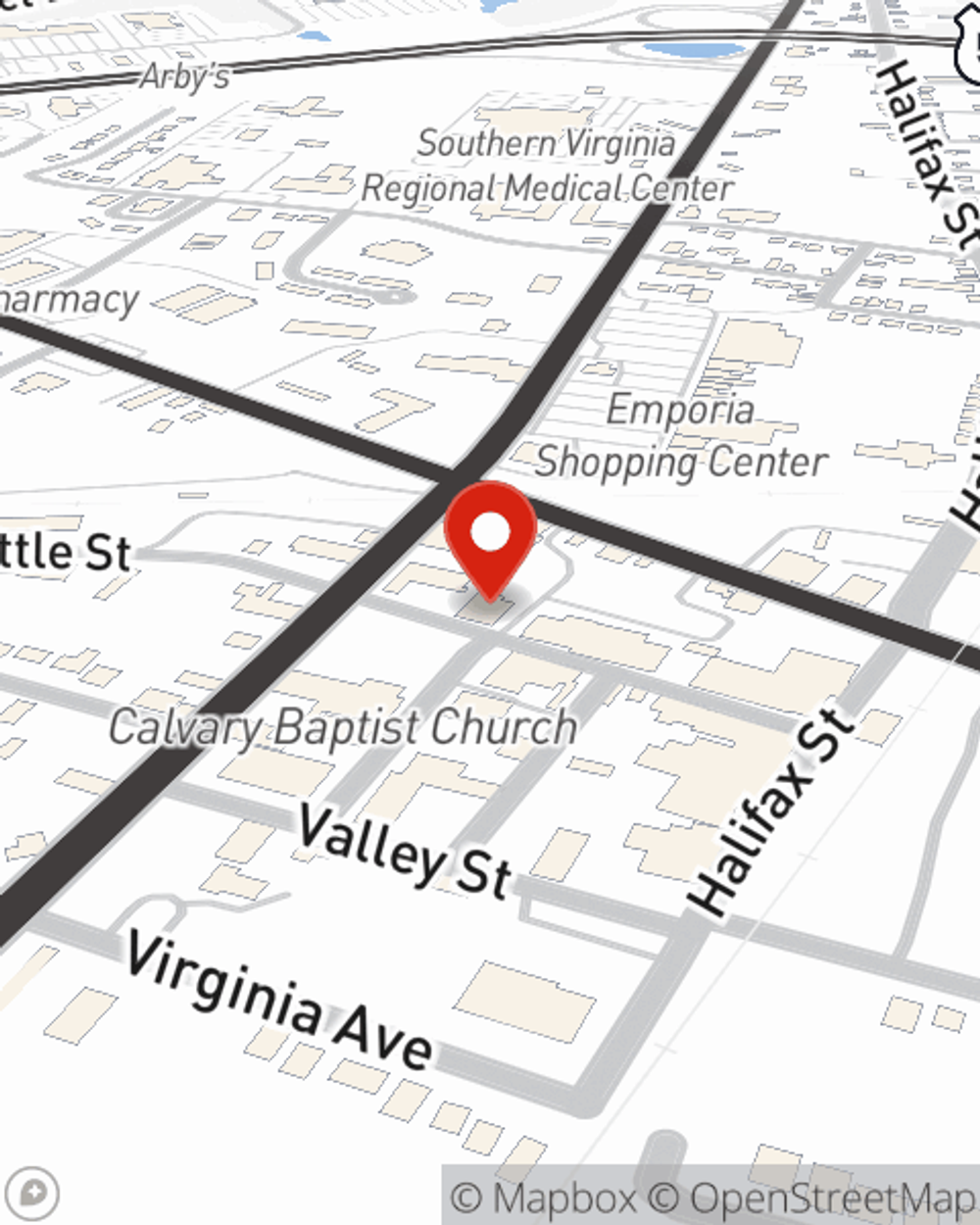

Peggy Malone

State Farm® Insurance AgentSimple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.